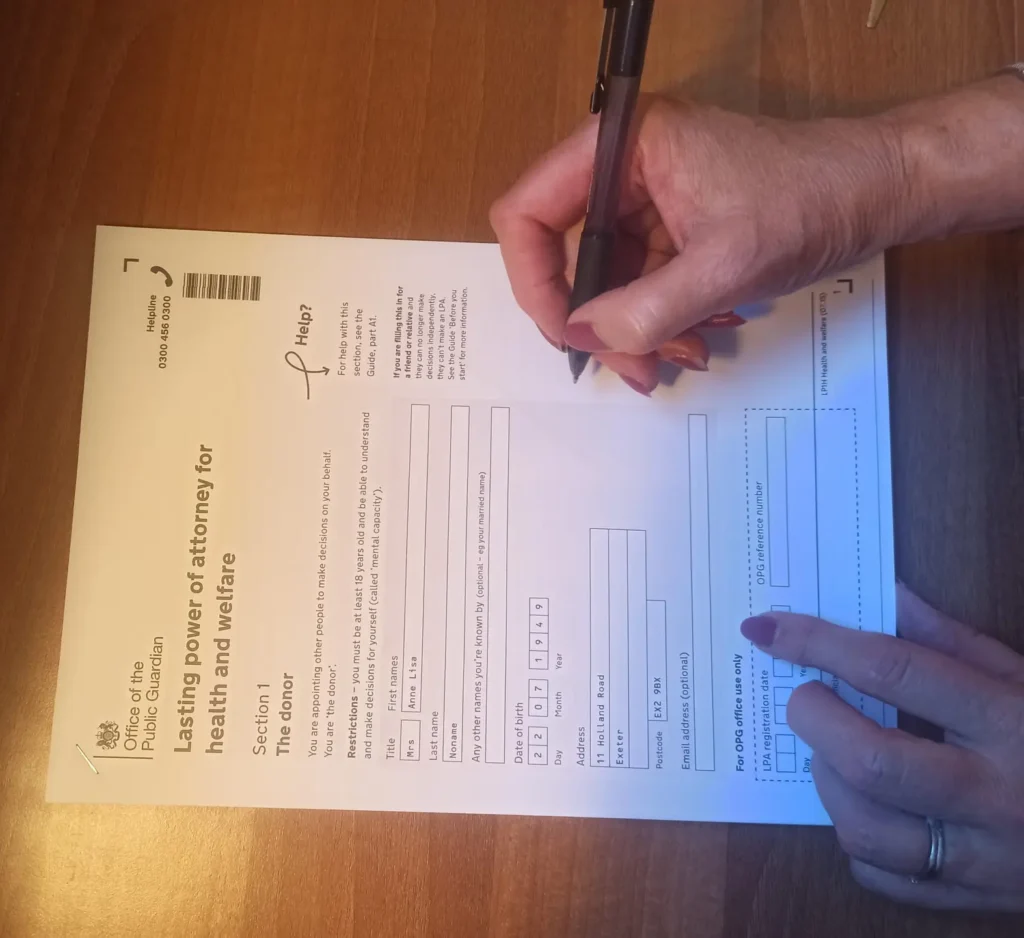

Lasting Power of Attorney (LPA)

What Is A Lasting Power Of Attorney (LPA)?

A Lasting Power of Attorney (LPA) is a legal document that allows you to appoint someone you trust; known as your attorney — to make decisions on your behalf if you ever lose the mental capacity to do so yourself. Many couples choose to appoint their spouse or partner as their attorney. This is important because, without an LPA in place, your partner cannot automatically make decisions or manage your affairs, even if you are married or in a long-term relationship.

Can’t I just wait until I am older to set these up?

While LPAs are often associated with older age or conditions like dementia, they are relevant for anybody over 18. Mental capacity can be lost at any age due to unexpected events such as a stroke, accident, serious illness, or brain injury. If that happens and you don’t have an LPA in place, your loved ones could face a complicated and costly legal process to gain the authority to make decisions for you — and even then, it may not be who you would have chosen.

Setting up an LPA early is simply a way to stay in control of who you trust to act on your behalf if the unexpected happens – regardless of your age.

If I am a parent, don’t I have the automatic right to handle my child’s decisions if they lose capacity?

Once your child turns 18, you no longer have automatic legal authority to make decisions on their behalf. So, if an 18-year-old loses mental capacity (due to an accident, illness, or condition like a brain injury), you cannot legally make medical, financial, or welfare decisions for them unless an LPA was set up beforehand.

What are the TWO types of Lasting Power Of Attorney (LPA)?

There are two distinct types of LPA, and each covers different aspects of your life:

Property and Financial Affairs LPA

This type of LPA gives your chosen attorney(s) the legal authority to manage your financial matters, including:

- Paying bills, managing your income and bank accounts, handling pensions or benefits and dealing with investments

- Buying, selling, or maintaining property

You can choose to let your attorney use this LPA while you still have mental capacity; for example, if you’re physically unwell or unable to get to the bank due to a stroke or mobility issue. This flexibility can be extremely helpful, even if it’s temporary until you recover.

Health and Welfare LPA

This LPA allows your attorney(s) to make decisions about your personal health and care but only if you lose the mental capacity to make those decisions yourself. It covers areas such as:

- Medical treatment and care including your decision about life sustaining treatment

- Decisions about where you live (e.g. going into a care home/hospice) and day-to-day care, including diet and routine

Importantly, your attorneys also have the legal right to challenge decisions — for instance, if they believe you’re being unfairly charged for care that should be state-funded. Without an LPA, loved ones can find it difficult to intervene in these situations.

Why both types of LPA matter:

Although you can choose to set up just one type of LPA, life is unpredictable — which is why many people choose to have both. This ensures that their trusted attorneys can step in to manage both financial matters and/or personal welfare decisions, if the need ever arises.

What are my options for managing my spouse or partner’s affairs if they lose capacity without having LPAs in place?

You would need to apply to the Court of Protection to be appointed as your spouse’s Deputy. This is a legal process that allows someone to act on behalf of a person who no longer has mental capacity.

It is time-consuming – applications can take several months.

It is usually more expensive than setting up an LPA. (Generally, in the £1,000’s)

You may need to provide regular reports and accounts to the court which may involve you paying further fees and causing additional stress at a difficult time.

Making LPAs Simple and Stress-Free

LPAs are powerful legal documents so it’s essential they’re set up correctly. The way an LPA is drafted can directly affect how and when it can be used. Mistakes or unclear wording can cause delays at the very moment it’s needed most.

That’s why it’s wise to get expert help

At Western Wills, we make the entire process clear, straightforward, and stress-free. It starts with an appointment at a time that works for you. We guide you through each stage, draft the documents correctly, and handle the registration with the Office of the Public Guardian; so your LPAs are ready to use without delay, should the need arise.